Introduction to the EU vs. Apple Dispute

The legal tensions between the European Union (EU) and Apple regarding app payment systems have emerged as a significant focal point in the ongoing discussion about digital market regulation. The core of this dispute centers on the EU’s regulatory framework, which seeks to promote competition and protect consumers, and Apple’s existing practices that dictate payment methods within its app ecosystem. This conflict raises critical questions concerning market control and consumer choices in an increasingly digital world.

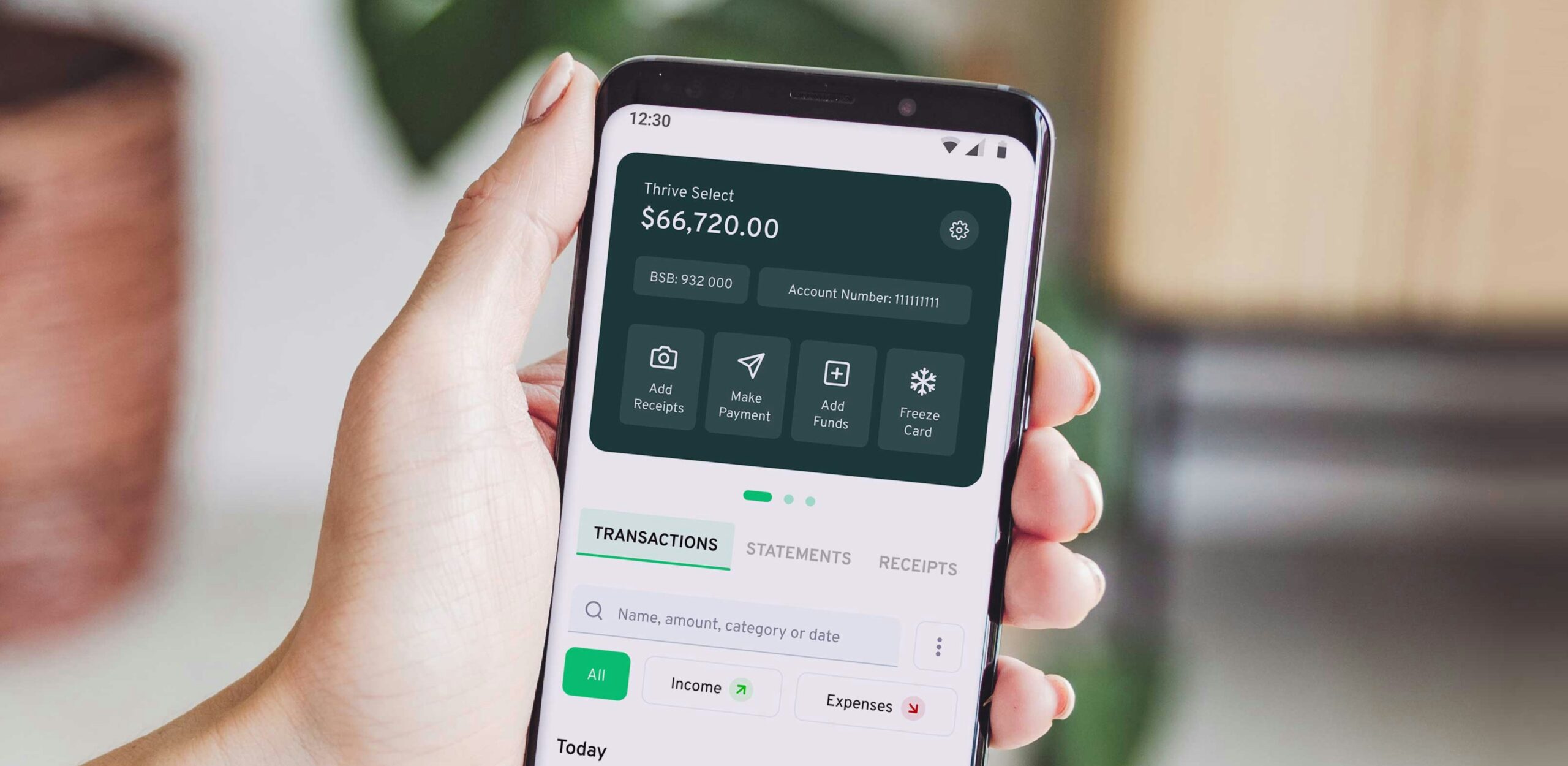

Apple’s App Store operates under a model that requires developers to use its proprietary payment system for in-app purchases. This includes a standard commission fee, which developers have argued is excessively high, thereby constraining their ability to compete effectively. The EU, noticing the potential anti-competitive nature of such practices, has taken a stand advocating for greater freedom in payment options, allowing developers to potentially use their payment systems. The EU’s aim is to ensure that developers are not locked into a single payment solution, which could stifle innovation and consumer choice.

This dispute is set against the backdrop of broader issues concerning digital sovereignty, where governments seek to regain control over the digital economy from large tech organizations. Additionally, the EU is reinforcing its internal regulations with initiatives such as the Digital Markets Act, which aims to create a level playing field for all competitors within the digital ecosystem. The implications of the EU’s actions are profound, as they could reshape how app payments are processed, impacting not only large tech companies like Apple but also smaller developers and end-users who rely on these services.

As the situation evolves, stakeholders from various sectors are vigilantly observing the developments in this legal conflict, which holds the potential to redefine economic interactions in the digital marketplace.

Understanding Anti-Steering Policies

Anti-steering policies serve as fundamental regulations within app ecosystems, particularly concerning how developers can interact with users regarding payment options. These policies effectively prevent developers from directing users to alternative payment methods outside of the app store’s designated payment systems, often leading to an elevated cost structure for consumers. For instance, when users make in-app purchases, they are typically required to utilize the payment mechanism imposed by the platform, such as Apple’s App Store or Google Play Store, which may entail a commission fee levied by these entities. This avoidance of external payment methods is precisely what anti-steering rules encapsulate.

The implications of these policies extend beyond mere payment processing. They wield significant influence over pricing strategies for developers, as they often have to factor in these additional costs when determining product pricing in the app. Consequently, this can lead to inflated prices for end-users, stifling competition within the digital marketplace. Newer app developers or smaller enterprises may find it particularly challenging to thrive under such constraints, as they lack the established user base or financial clout to absorb or offset the imposed fees effectively.

Moreover, the restriction of steering can limit user choice, as consumers must rely solely on the app store’s payment processing framework. Users thus may miss out on potentially more favorable pricing options or promotions available through other channels. The need for a balance between platform regulation, developer rights, and consumer interests remains ever-present as policymakers and industry leaders grapple with these dynamic issues in the ongoing dialogue about fairness and competition in digital marketplaces.

EU’s Regulatory Actions Against Apple

The European Union (EU) has consistently taken steps to address concerns surrounding competition and consumer rights, particularly in the digital marketplace. In its regulatory actions against Apple, the EU has initiated multiple investigations aimed at examining the company’s potential anti-competitive practices. The focus has primarily been on Apple’s App Store policies, especially regarding the payment systems mandated for app developers.

In 2020, the European Commission launched formal inquiries into Apple’s practices, following complaints from developers, including Spotify and others. These complaints highlighted the perceived restriction imposed by Apple, which required developers to use its in-app purchase system. This requirement effectively steers users towards Apple’s payment system, limiting alternative payment options and potentially harming consumer choice.

The EU’s investigations revealed that these practices may contravene European competition laws, leading to the risk of a prolonged legal battle. In April 2021, the Commission issued a statement of objections to Apple, indicating a preliminary assessment that Apple’s behavior may infringe on EU laws designed to promote fair competition. As part of its proceedings, the Commission has emphasized the importance of transparency and fairness in digital marketplaces, aiming to cultivate an environment that fosters innovation while protecting consumer interests.

The legal consequences of these proceedings could be significant for Apple. If found in violation of EU regulations, the company could face substantial fines, potentially reaching up to 10% of its global revenue. Moreover, the EU’s broader goals involve establishing a regulatory framework that not only addresses Apple’s practices but also sets a precedent for other tech giants operating within the region. The actions taken against Apple signify the EU’s commitment to ensuring a fair digital economy characterized by competition and respect for consumer rights.

Apple’s Defense and Business Model

Apple’s defense of its practices surrounding app payments and the implementation of anti-steering measures is deeply rooted in its established business model. The company argues that its commission structure, which typically involves a 30% fee on app sales and in-app purchases, is essential for subsidizing the extensive infrastructure that underpins its operating system. This infrastructure, including the App Store, provides developers with a platform to reach millions of users while maintaining stringent security protocols.

Apple posits that the fees collected through its commission model allow it to invest significantly in ensuring a robust and secure ecosystem for both developers and consumers. This commitment to security is highlighted as a key aspect of user experience within the App Store. By enforcing anti-steering policies, Apple aims to prevent developers from directing users away from its payment system, ensuring that consumers benefit from the protective measures it implements. The company emphasizes the importance of maintaining an integrated environment where the user experience is prioritized, thereby justifying the necessity of its app payment system.

Furthermore, Apple claims that its ecosystem supports innovation by providing tools and resources for developers, which in turn enhances the overall quality of apps available to consumers. The company also states that this framework helps to prevent fraud and protect users’ data, which are increasingly critical aspects of digital transactions. Thus, Apple defends its business model, arguing that its practices are not only beneficial to its bottom line but also help to create a secure and user-friendly environment for app distribution and payment processing.

Impacts on Developers and Consumers

The ongoing conflict between the European Union (EU) and Apple regarding anti-steering provisions has significant implications for both app developers and consumers. At the heart of this dispute is the control over payment processing within mobile applications, which directly impacts how developers monetize their offerings. Should the EU succeed in enforcing changes to current regulations, developers may gain the ability to utilize alternative payment systems, potentially resulting in reduced transaction fees. This transition would empower developers to offer more competitive pricing structures for their applications, thereby enhancing profitability and possibly leading to a broader diversity of app offerings.

Additionally, the regulatory changes may encourage the proliferation of innovative business models. Developers could implement richer features, subscription models, or freemium strategies without the substantial overhead imposed by Apple’s payment system. This broadening of options could help smaller developers and startups, which often struggle under the current commission rates levied by Apple. The result may foster an ecosystem that nurtures creativity and accelerates development, ultimately benefiting the consumer with more choices and tailored services.

For consumers, the ramifications of this conflict could manifest in various ways. If app prices drop due to reduced fees passed on by developers or if new developers enter the market, users may be presented with a wider variety of applications — each competing on price, functionality, and user experience. Furthermore, the potential introduction of different payment options may enhance the overall user experience, as consumers could select the payment method that best suits their needs. Conversely, however, there are concerns regarding security and data privacy, which may arise from a diversification of payment systems. Therefore, finding a balance between regulatory changes and maintaining consumer safety will be crucial in this evolving landscape of app payments.

International Implications of the EU’s Stance

The European Union’s firm position on Apple’s anti-steering practices has significant potential to influence regulatory frameworks and app ecosystems in other regions of the world. As the EU takes a stand against a perceived monopolistic behavior in the app market, it paves the way for similar legal challenges in jurisdictions that have been observing the EU’s regulatory actions closely. Other countries may interpret the EU’s definitions and rulings as a template for developing their own regulations, particularly in markets where app stores hold substantial power over developers. This influence could be particularly pronounced in regions like North America and Asia, where tech giants operate under varying degrees of governmental oversight.

Countries with robust technology sectors, such as the United States and South Korea, may face growing pressure to reassess their regulations on app payments and marketplace controls. Given the EU’s strong enforcement mechanisms and willingness to penalize violations, this could lead to a marked shift in how corporations operate globally. For example, U.S. regulators may find it necessary to address similar concerns regarding app marketplaces, thereby stimulating discussions around monopolistic behaviors and the treatment of small developers. Additionally, emerging economies, eager to attract tech investments, might consider adopting similar regulations to ensure fair competition and support local developers.

The ripple effects of the EU’s actions extend beyond mere legal frameworks to influence international business practices as well. Corporations may need to adapt their operations to align with more stringent regulatory conditions across various markets, potentially leading to increased operational costs. Additionally, if global technology companies face an assortment of regulatory guidelines due to differing national responses to the EU’s stance, the complexity of compliance will likely escalate. Overall, the EU’s decisive action against Apple’s anti-steering policies sets a precedent with far-reaching implications for the future of app payment regulations worldwide.

Comparative Analysis: EU vs. Other Regions

The regulatory landscape surrounding app payments and antitrust actions varies significantly across regions, particularly when contrasting the European Union (EU) with the United States (US). In the EU, the approach is marked by a proactive stance on consumer protection and competitive markets, aiming to curb the dominant positions held by tech giants like Apple. The EU’s rigorous regulations focus on transparency and fairness in digital markets, which have led to the enforcement of anti-steering provisions. Such provisions necessitate that app developers inform users about alternative payment methods, consequently limiting Apple’s ability to control app payment methods directly.

Conversely, the US has historically adopted a more laissez-faire attitude towards antitrust regulation. Here, the focus has primarily been on fostering innovation and competition without stringent oversight on payment platforms. For instance, while the US has seen substantial legal actions against monopolistic practices, the emphasis tends to be more on the preservation of market competition rather than stringent regulation of payment systems. This differential approach results in a more fragmented regulatory framework, where tech giants may navigate varying levels of oversight and accountability based on state or federal laws.

Moreover, cultural factors play an integral role in shaping the regulatory philosophies of the EU and US. The EU places a significant value on consumer rights and data protection, as illustrated by the General Data Protection Regulation (GDPR) and various digital market regulations. In contrast, US regulations are often influenced by market dynamics and the principle of maximizing shareholder value, leading to a cautious stance towards regulatory interventions. This divergence impacts how companies like Apple strategize in both regions, necessitating adjustments in their payment systems and marketing strategies based on local regulations.

Future of App Payments: Trends and Predictions

The landscape of app payments is undergoing significant transformation, driven by advancements in technology, regulatory changes, and shifts in consumer behavior. As global app usage continues to soar, the methods of payment within these applications are being scrutinized more than ever. One of the critical factors influencing this dynamic is the ongoing conflict between the European Union (EU) and major tech companies like Apple, particularly concerning anti-steering measures that dictate how developers can process transactions.

Currently, the dominance of in-app purchasing systems, such as Apple’s own payment platform, raises questions surrounding competition and choice. Developers and consumers are increasingly vocal about their desire for alternative payment solutions that bypass the exclusive systems mandated by platforms. This demand for flexibility may lead to a gradual adoption of various payment methods, enabling developers to integrate third-party payment processors. This shift is likely to enhance user experience by providing more options, which is increasingly important in a rapidly evolving digital ecosystem.

Moreover, as regulatory scrutiny intensifies, especially from the EU, we can anticipate stricter guidelines governing app payments. Enhanced transparency and consumer protection measures may emerge, compelling companies to reevaluate their payment strategies. These regulations could empower users by giving them greater control over their payment choices. Furthermore, as technology progresses, innovations such as blockchain and cryptocurrency may also find their place in the realm of app payments, offering a secure and decentralized alternative.

Considering these factors, predictions suggest a more diversified landscape for app payments in the coming years. Both developers and consumers may enjoy increased options and control over how transactions are conducted. Ultimately, as the EU continues its campaign against perceived monopolistic practices, the outcomes of these regulatory battles could have profound implications for app payment systems, shaping the future interactions between users, developers, and platform owners.

Conclusion: Who Will Ultimately Control App Payments?

In examining the ongoing conflict between the European Union (EU) and Apple over anti-steering regulations, we observe a complex interplay of power that raises fundamental questions about control within the app ecosystem. The EU’s efforts to regulate app payment systems are indicative of a broader push for transparency and fairness in digital markets, aiming to empower developers and consumers alike. This regulatory environment seeks to dismantle monopolistic practices by enabling alternative payment methods, which could significantly reshape the app economy.

Apple, on the other hand, has historically maintained stringent rules regarding app payments, primarily to safeguard user security and ensure a cohesive experience within its ecosystem. Apple’s stance underscores the challenge of balancing corporate interests with regulatory mandates. As legal battles unfold, the ultimate question revolves around who will hold the reins of control over app payments—a global corporation or a coalition of regulators striving for equitable market conditions.

The implications of this conflict extend beyond the immediate concerns of app developers or consumers; they reflect a larger narrative concerning digital rights and market competition. If the EU prevails in enforcing anti-steering regulations, it may catalyze similar regulatory frameworks worldwide, promoting a more democratized app marketplace. Alternatively, a victory for Apple could affirm the corporation’s control over payment processes, potentially stifling innovation and maintaining a status quo that favors established players.

As stakeholders in the app economy watch these developments closely, the outcome of this showdown may define the future landscape of app payments. The final authority in determining this control may hinge on how effectively regulatory bodies can navigate the challenges posed by powerful tech corporations while advocating for consumer and developer interests.